Complete your projects with

Rebuild Financial

We Specialise in Private Construction Loans

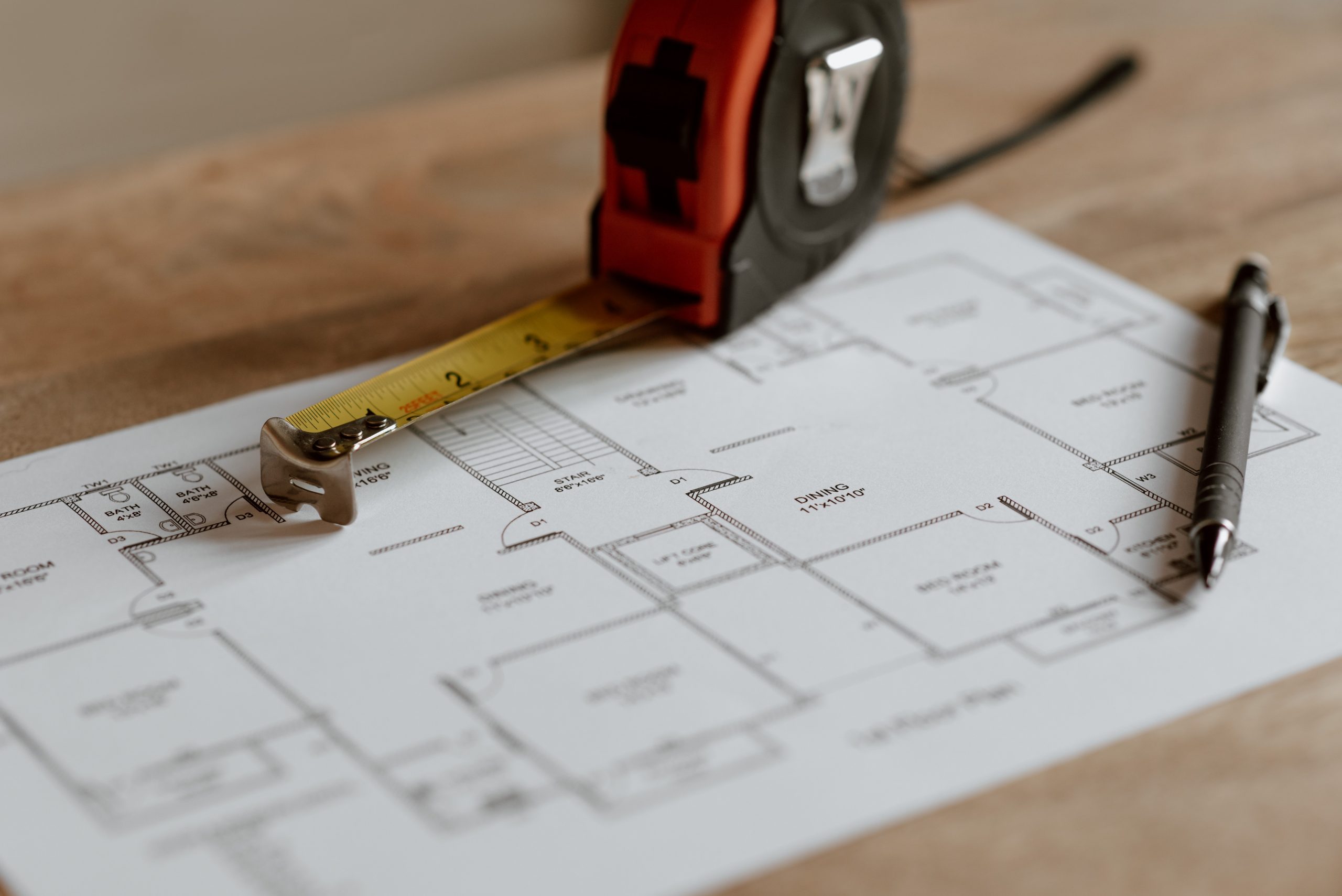

Construction loans are a pivotal tool for developers and business owners in Australia, especially when traditional lending institutions falter. In a post-COVID-19 world, where uncertainty lingers in the air, securing a construction loan through conventional banks can be a daunting challenge. Enter Rebuild Financial, your construction finance specialist, offering a streamlined private construction loan solution to keep your building projects on track.

What is a Private Construction Loan?

Construction loans are home loans best suited to building or renovating a new property, rather than buying an already established one. As such, they follow different loan structures.

Often enough, you won’t need the sum of your loan upfront during the construction process. Construction loans differ from regular home loans in that they generally grant you access to progressive drawdowns.

When taking a construction loan with Rebuild Financial, you can access instalments of funds whenever you need, as you move through the many stages of a construction project.

Non Bank Construction Lender

Hassle-free, across Australia

Finding the perfect property is not easy, and while building your own can be a grand undertaking, it gives you freedom to get creative with a design that best suits your lifestyle. But funding a project can be time-consuming and, more importantly, cost intensive.

If you have plans to initiate a construction project - be it demolition, renovation, or starting fresh, a construction loan is a sound consideration. Rebuild Financial specialises in private construction loans. If you're having trouble securing a loan, we're here to help - we even work with bad credit.

Developer & Construction Top Up Loans

At the core of Rebuild Financial's ethos is a commitment to helping you understand and obtain the right construction loan for your needs.

How does a Construction Loan work?

Construction loans are designed for financing building and development projects. Unlike regular loans, they address the unique risks and costs associated with construction. Traditional lenders may shy away from such perceived risks, but Rebuild Financial thrives in customizing these loan packages with over 200 recognised private lenders throughout Australia.

Cost and Ratios: The Foundations of Your Loan

Understanding the full cost of construction is crucial before embarking on your project. This encompasses both soft costs (like architectural plans and council permits) and hard costs (such as labour and materials).

Two key ratios are crucial:

- Loan to Cost Ratio (LTC): The cost of construction divided by the loan amount. A lower ratio signifies reduced risk and increased lender confidence.

- Loan to Value Ratio (LVR): The projected market value of the completed property divided by the loan amount. A lower LVR is typically more attractive to lenders.

1

2

3

Our Private Construction Loans:

Non-Bank Construction Loans

If the banks are turning you away, or if you simply prefer not to use one, Rebuild Financial has you covered.

Construction Top-Up Loans

Looking to acquire some funds to cover unexpected costs in a construction project? We can help get you a loan even if you've already begun building.

Private Construction Loans

Private loans are shorter-term loans that work great if you're looking to get something done quickly. Cut through the hassle of borrowing traditionally.

Send an enquiry to learn how much you're eligible for

Can't get a construction loan from a traditional lender?

Today, private lenders offer a legitimate alternative to traditional bank construction loans, creating a competitive lending environment that borrowers can greatly capitalise on.

Private lenders will specialise in one form of lending or other. Of course, Rebuild Financial focuses on construction. But more than that, we’re here to help if you’re having trouble scoring a traditional bank loan.

Private vs Bank Lending

As with any large institution, a bank’s size and stability is a double-edged sword.

Larger organisations operate under a more complicated hierarchy, which means increasingly complex business processes and more overheads.

This often results in slower services and longer wait times. If you need funds urgently, non-bank loans could be the choice for you, and this is one of the things we offer.

There will be slightly higher interest rates, though this is to account for the higher risk tolerance of our private lenders.

Lo Doc? No Problem.

We specialise in helping clients with minimal documentation or past arrears – whether due to being self-employed or any other reason. The application process is easy and fast; just send in the short application and one of our experienced lending managers will get back to you within a single working day.

If you’re having troubles with bad credit, be sure to contact us about our bad credit construction loans. As always, we’re happy to help, and this could also be a great way to build both your property and your credit score.

Enjoy full transparency.

No hidden fees or charges are included, and you’ll have a clear view of the status of your loan.

Rebuild Financial will arrange a loan with the lender based on your needs, so you don’t have to worry about doing everything by yourself.

As a final bit of advice – equity is required. Prepare the details in advance and we'll be ready to help you out with a loan nearly instantly.

Why Rebuild Financial?

Licensed lenders across Australia

Years of experience in non-bank lending

Client-centric customer service

A word from our CEO

"If your paperwork's not in order but your development is, we can look into funding your project for you. Rebuild Financial has over two decades of experience in private and construction lending, and with the history of non-bank lending in mind, I will personally see to it that you get the best deal we can offer."

Alex Dryden

CEO

Seamless Construction Loan Financing with Rebuild Financial

We ensure you're well-prepared to engage in construction financing. If complexities arise, our expertise allows us to handle them, offering you a plethora of options with greater flexibility than traditional lending avenues.

We can help secure favourable terms:

- Provide a sizable deposit

- Offer substantial lender security

- Aim for a first mortgage, but know that Rebuild Financial caters to diverse scenarios,

- including second mortgages and mezzanine funding

Why Partner with Rebuild Financial for Your Construction Loan?

Our network of private lenders can provide swift solutions, often not requiring financials or bank statements, making the application process faster than traditional banking.

Minimise Loan Repayments with Progressive Drawdowns

This feature allows you to manage your loan repayments effectively by accessing funds progressively, which can significantly reduce interest costs during the initial stages of construction.

Broad Application of Construction Loans:

- From multi-residential construction to commercial developments,

- Rebuild Financial can cater to a wide array of projects:

- Multi-Residential Construction Projects

- Land Developments

- Larger Construction Projects

- Commercial Property Renovation

- Commercial Property Development

- Single-Dwelling Homes

Tailored Financial Solutions

Whether you're a trust, company, or individual, we offer financial solutions that are customised for your particular construction needs.

Quick and Straightforward Process

Our network of private lenders can provide swift solutions, often not requiring financials or bank statements, making the application process faster than traditional banking.

Expert Guidance

Our lending managers have a profound understanding of construction finance, streamlining the process and focusing on what's important to fund your project efficiently.

Our Track Record Speaks for Itself:

- 200+ Licensed lenders across Australia

- 25 years of experience in non-bank lending

- 100% Client-centric customer service

Enjoy full transparency.

No hidden fees or charges are included, and you’ll have a clear view of the status of your loan.

Rebuild Financial will arrange a loan with the lender based on your needs, so you don’t have to worry about doing everything by yourself.

As a final bit of advice – equity is required. Prepare the details in advance and we'll be ready to help you out with a loan nearly instantly.

Apply now or fill out our quick form to check your eligibility for a construction loan. An experienced lending manager will respond within 24 hours to address your queries and guide you through the next steps.

Let Rebuild Financial be the cornerstone of your project's success. Start building your dream today!